A Deep Dive Into Student Loan Repayment Assistance Benefits

Justin Held, CEBS

July 16, 2019 - IFEBP

Workers are becoming increasingly burdened by growing student loan debt

balances, which by some estimates have reached an average of $28,650 per graduate. According to

the new International Foundation study Education Benefits: 2019 Survey

Results, employers are recognizing this burden and taking

action. A small proportion of responding organizations is offering to pay down

portions of workersf loans to retain productive workers and attract new

candidates. Below are some key takeaways from our survey about this new

educational benefit that is drawing significant attention.

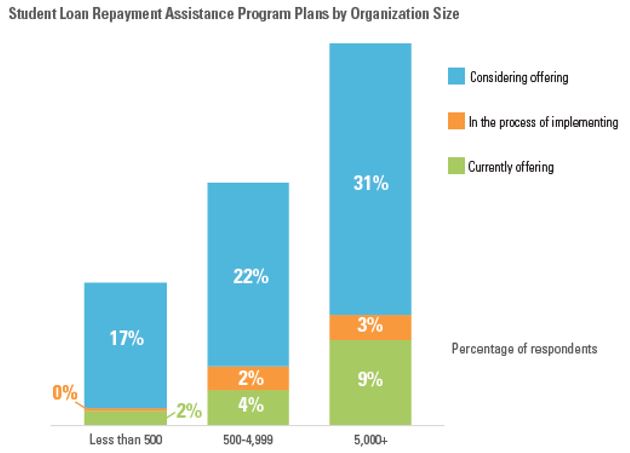

Student Loan Repayment Assistance Offerings

- Four percent of responding organizations already offer some sort of

student loan repayment assistance benefit. Also, 1.6% of respondents are

currently in the process of implementing a loan repayment program, and an

additional 22.6% are considering implementing a program.

- Organization size plays a role in the ability to offer loan repayment

programs. Large employers (9.3%) are much more likely to offer loan repayment

assistance than small (1.7%) and midsized (3.7%) organizations.

- In addition, large employers are more likely than both small and midsized

organizations to consider adding a program.

- Employers located in the Northeast are more likely than those in other

regions to offer a student loan repayment assistance program.

Considering/Implementing Student Loan Repayment Assistance

Offerings

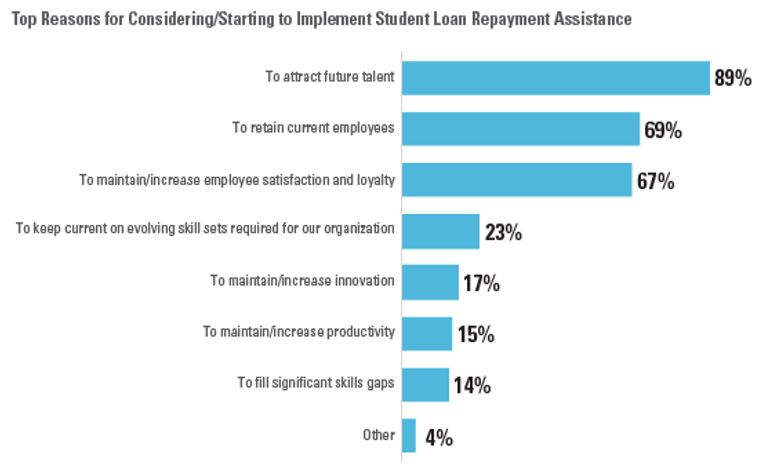

Respondents that are considering or are in the process of implementing a

student loan repayment assistance program were asked about their motivations for

offering a program

- Organizations that are considering/implementing are doing so to attract

future talent (89.4%), retain current employees (69.1%), and maintain/increase

employee satisfaction and loyalty (67.0%).

- Organizations are also doing so to keep current with evolving skill sets

required for organizational success (22.9%) and to maintain/increase

innovation (16.5%).

- In examining responses by organization size, respondents from large

employers are more likely to consider offering these benefits to

maintain/increase the productivity of their workforces.

Potential Barriers/Challenges to Offering Repayment

Benefits

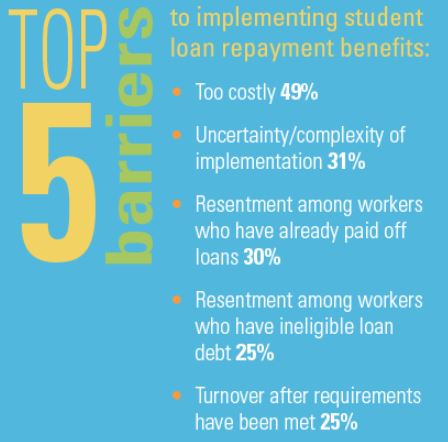

Respondents were also asked about some of the potential barriers and

challenges they are facing in implementing or considering programs.

- Some potential barriers and challenges to implementing a student loan

repayment program include cost (48.9%), uncertainty/complexity of

implementation (31.4%), and potential resentment among workers who have

already paid off loans (29.8%) or have ineligible loan debt (25.0%).

- Employers are also concerned about potential turnover after repayment

requirements have been met (25.0%) and tax issues (21.3%).

- In looking at organization location, employers in the Northeast and West

are more likely to cite difficulty in determining eligible workers/candidates

as a barrier/challenge.

- In addition, employers in the Midwest are more likely to cite a longer

tenured employee population as a barrier to offering these benefits.

- Employers located in the Northeast are more likely than those in other

regions to cite the uncertainty/complexity of implementation as a

barrier.

- Looking at organization size, respondents from smaller firms were more

likely than those from midsized and large firms to cite little management

support as a potential barrier to offering repayment benefits.

Additional Insights From Those Offering Student Loan Repayment

Programs

Finally, those organizations that are currently offering student loan

repayment assistance benefits were asked a number of questions about their

programs. Due to the small number of organizations offering this benefit, the

International Foundation cautions against drawing broad conclusions from their

responses. However, below are a number of key findings that were gleaned from

their responses.

- An overwhelming majority of respondents that offer student loan repayment

benefits offers them to full-time salaried and hourly employees. A smaller

proportion extends the benefits to part-time workers.

- Those offering these benefits repay loans related to a broad array of

coursework, most commonly associate degree, undergraduate-level and

graduate-level courses.

- Most organizations that have a loan repayment program have had one for two

years or less.

- Most organizations that offer such a program have specific

length-of-service requirements. Other common limitations include fixed annual

dollar levels for repayment and restricting repayment to loans that led to a

degree.

- A small proportion of respondents that have a student loan repayment

assistance program has a payback requirement if the employee leaves the

organization.

- The majority of organizations that offer repayment benefits process their

payments through an external vendor as opposed to doing so internally.

- Those organizations offering student loan repayment assistance benefits

most often do so to attract future talent, retain current workers, and

maintain/increase employee satisfaction and loyalty.

- A large majority of respondents that offer these programs rates them as

successful. To gauge success, they are tracking engagement measures, retention

rates, utilization rates and recruitment rates.

- Some common barriers/challenges to the implementation of student loan

repayment assistance programs include difficulty in determining program return

on investment, resentment among workers who have ineligible loan debt and

communication challenges.

- As part of their program communications, program sponsors often target

recent graduates and those seeking entry-level positions.

- Several proposals have been introduced that would allow organizations to

redirect funding from retirement or paid-time-off/vacation account

contributions to student loan assistance. In general, organizations are

considering these approaches going forward.